Mobile Banking App Development: How to Create a Banking App & How Much Does It Cost?

September 25, 2022

Mobile development

FinTech

Table of contents

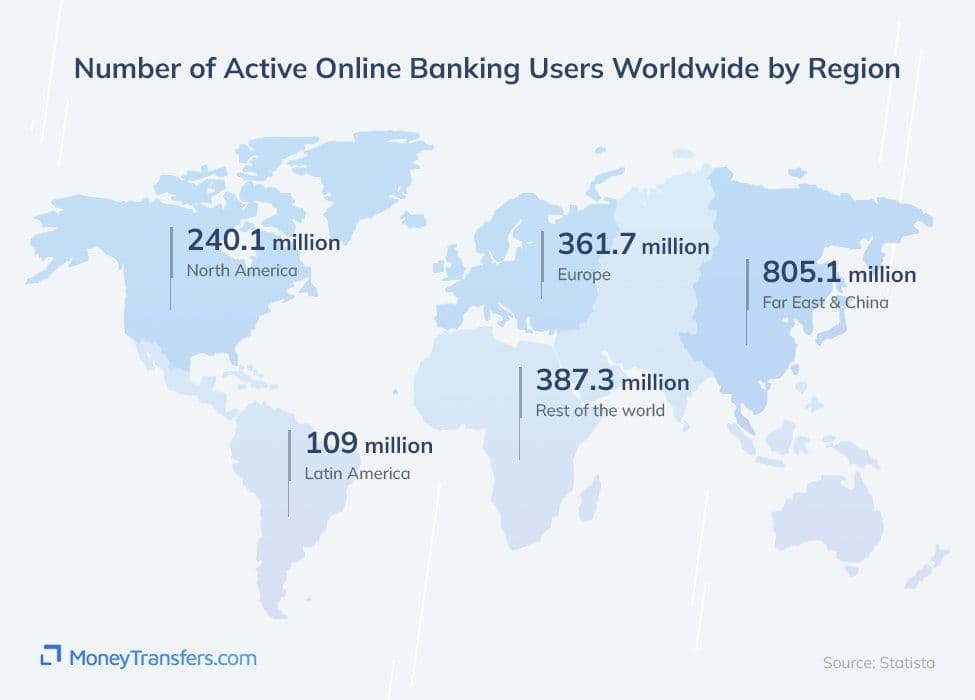

The mobile banking application market grows rapidly and is expected to reach approximately $1,82 billion by 2026. In comparison, in 2018 this number was only $715,3 million. According to MoneyTransfers, 39% of users worldwide apply banking apps as the main banking method. Just look at this mind-blowing users statistic by region:

Source: MoneyTransfer & Statista

Thanks to mobile banking apps, financial services have not just become more accessible, secure, and flexible but have also turned into one of the most innovative industries nowadays. Such up-to-date technologies like blockchain, IoT, big data, AI, cloud computing, voice banking, etc. set the global trend in the development of mobile banking apps and help financial companies outpace competitors.

If you also want to conquer the market with an online banking application, here is a brief guide that will help you deal with the key questions regarding mobile banking apps.

Without further ado, let’s dive deep into the topic!

Trends in Mobile Banking 2024

Ever thought to create a banking app? Awesome! But first, we suggest looking at the nearest future of mobile banking so you’re better equipped for informed decisions. We handpicked the most intriguing trends that will dominate in 2024.

Artificial Intelligence. AI-driven algorithms can provide customized recommendations for efficient budget planning. AI offers a proactive approach to money management.

Chatbots aren’t new to the financial industry but soon we will see an upsurge of chatbots. That mainly includes customer support and assistance for routine user inquiries.

Machine Learning (ML) technologies can analyze spending patterns to predict financial behaviors. Based on the insights, users can adjust their budgeting. If you want to build a banking app, ML is a must-have.

Blockchain. The security concerns are always topical as the fraud schemes are very sophisticated. Therefore, to create a mobile banking app you need to consider a blockchain. It can not only ensure tamper-proof transactions but also reduce processing times.

Biometrics. Password recovery can be a cumbersome process, involving lengthy questions or OTP codes. Biometric account recovery lets users regain access to their accounts through biometric verification.

In 2024, the idea to build a mobile banking app must not stand alone but be considered alongside AI, chatbots, ML, blockchain and biometrics. This all-around approach can help your app take a leading position on the market.

Mobile banking app: what is it and key features

To start with, we should mention that banking apps are not the only way to provide banking services via phone. In general, there are 3 main types of mobile banking services:

SMS-banking

It’s mostly used by customers that don’t have Internet-enabled gadgets. After registering your phone number in the bank database, you can receive notifications regarding important actions related to your bank account.

USSD-banking (Unstructured Supplementary Service Data)

It’s a type of digital banking that works even when you have no Internet access, there is no money in your mobile account or your mobile number is blocked. You just need to enter a specific code on your phone (for example, *123#), hit the Call button and your bank will provide you with the required info.

App-based banking

It's the most popular type of mobile banking that provides almost limitless opportunities. In simple terms, a mobile banking app represents the range of banking services and transactions via your phone.

Let’s take a closer look at some of the mobile banking apps features that are always on-demand among users, so you should think of them if you need to create a banking app:

- Ability to conduct all the banking activities and get all the key services that are accessible in offline banks - check bank accounts, keep track of the payments, make transactions, pay utility bills, book train/flight bills, get brief reports and notifications and so on.

- Enhanced security - most banking apps apply advanced security features: two-factor/voice/biometric authentication, password encryption, limitation of the number of login attempts, usage of the cryptographic keys storage, AI-powered behavior analysis, etc.

- Mobile check deposit - simply using your smartphone camera, you can scan a check from the front and back sides and transfer these digital images to your banking app. Then in just a few minutes, all the deposit info goes to your bank account and you can conduct further required actions.

- QR code confirmations & payments - the usage of QR codes provides customers with a fast, secure, and convenient way to conduct cashless payments and other banking activities. Moreover, it’s widely applied in banking apps for branding and marketing, donations, identification, and so on.

- Smart Chatbots - thanks to AI and other technologies, you can embed a chatbot into your mobile banking app and provide your users with a personalized approach and smooth 24/7 support. In such a way, you can increase customers' satisfaction and loyalty.

And now let’s move to the most popular apps that implement these features successfully.

Top 3 successful mobile banking apps you can inspire from

According to Business Insider, the best mobile banking apps as of September 2022 are:

Ally

App Store Rating: 4,7 , #85 in Finance

Google Play Rating: 3,9, 1M+ downloads

Why this app is cool?:

- no overdraft fees

- mobile check deposit

- ability to use Zelle and pay anyone with a U.S. bank account effortlessly

- 24/7 Ally Assist

- card control system that makes it easy to control all the actions related to your card

- features that help smartly organize money and visualize your goals for savings

- goals tracker

- features for automated investing

Capital One

App Store Rating: 4,9, #5 in Finance

Google Play Rating: 4,6 , 10+M downloads

Why this app is cool?:

- card Lock feature thanks to which you can quickly disable your card in case it was lost or stolen

- mobile check deposit

- ability to pay bills and loans

- chatbot Eno - client’s Capital One assistant

- notification system

- ability to control all the actions related to your credit card

Chase Mobile

App Store Rating: 4,8, #6 in Finance

Google Play Rating: 4,4, 10+M downloads

Why this app is cool?:

- banking & investing in one app

- mobile check deposit

- ability to send and receive money with Zelle

- ability to schedule and edit payments

- ability to track your daily spending

- credit monitoring & 24/7 fraud monitoring

Mobile banking app development stages

Now when you have a general idea of what a mobile banking app is and what features it should include, you can think of starting its development. It usually consists of several big and important stages:

Discovery & Planning

You should start to create a banking app from the deep investigation of the target audience, market conditions and trends, as well as with thorough competitor analysis.

This research will help you better understand your user’s needs, problems, and desires. Therefore, you can roughly assess the need for your app on the market and come up with the solution and value that will really matter.

You will end up this stage with comprehensive research results, strategy, and detailed planning of further steps that will lead you to the desired results.

Foundation of the security base

Mobile banking apps have a lot to do with sensitive personal data, so you should take care of the security measures long before the start of the fintech app development process.

Think carefully of the system for secure passwords, auto-logout, secure platforms to store the user’s data, security certificates, the most reliable options for user authentication, etc.

UI/UX Design

For this type of mobile apps user-friendly UI/UX design is not just something fancy but a crucial need. The thing is that most of all when dealing with money-related tasks or processes, people usually are afraid to do something wrong. That’s why when you create a banking app you need to ensure that you’re developing a design that is easy to understand and navigate.

Development & Testing

And that is when your idea turns into something “tangible” - code. Depending on the complexity of the software you plan to build, you may need a team of 1 or several software developers, as well as 1 or several QA engineers - they will take care of all the possible bugs or imperfections in the created code and solve them before the delivery of the final result to you.

Integration with the 3d-party systems & launch

Your last but not least task is to integrate with the reliable and secure platforms that may be needed to make your app operate smoothly, for example, user verification tools, data analytics tools, in-app messaging & notification systems, chat bots, etc.

Top 3 Technologies to Build a Mobile Banking App

To create a banking app, it’s crucial to choose the right tech stack from the very start. The best options we suggest are Flutter, React Native, and Java. Let’s take a quick look at the benefits of each of them.

Java

Stability. Java is a technology that has proven reliability through decades. No room for experimenting with unreliable technologies.

Platform Independence. Java is known for its "write once, run anywhere" capability. Now, your app can be used on various platforms.

Security & Scalability. Java's architecture allows easy scalability, letting your app grow when need be. Strong encryption and authentication protects sensitive data.

Flutter

Cross-Platform. Flutter allows you to write code once and run it on both iOS and Android. This dramatically reduces development time and costs.

Customizable UI. Flutter offers a wide range of widgets to create highly customized and visually appealing user interfaces.

Fast Performance. Flutter's "hot reload" feature enables real-time code changes, making it easier to fine-tune the app's performance and fix issues quickly.

React Native

Reusable Code. Like Flutter, React Native allows writing code once and deploying it across multiple platforms.

Component Library. React Native has a vast library of pre-built components, enabling rapid development of key features.

Maintenance. The modular architecture makes updating an app straightforward, reducing development costs.

Mobile banking app development costs

It’s really difficult to provide precise numbers as mobile banking app development costs depend on many factors: the complexity of features, technologies, urgency, developers and other tech experts’ rates etc. According to different resources, development costs can start from $10 000 and vary to

$1 000 000 and higher.

What we can say for sure, is how to cut development costs and spend your resources in a smart way when you plan to create a banking app:

Before the development of the full version of your app, create the MVP. This is an app with a very basic set of features and design, however, you can launch it to test your idea, gather first users and evaluate their feedback, and then, based on this, make necessary changes in the main app. Moreover, with MVP you can earn your first money and attract more investors.

Prioritize your mobile banking app development tasks. Even if it seems like everything is important, you should try to define core features and then move to more advanced functionality step-by-step. That’s how you can prevent the situation when all the budget is spent on several unnecessary features but the core functionality is still not ready.

And last but not least: think of working with an offshore tech team - their prices are much lower than in the USA or large European countries, however, they still deliver high-quality results.

For example, you can contact Perfsol. We're a Ukrainian offshore team with great experience in mobile banking app development. Moreover, Perfsol has been selected among the Top Android App Development Companies by Designrush. So if you want to create a banking app or need some consultations, we’ll be happy to help.

Author

CEO

I follow a proactive approach in life to solve simple to complex problems systematically. I fully understand the nexus of people, process, technology, and culture to get the best out of everyone at Perfsol to grow the businesses and deliver a societal impact at the national and global levels.

FAQ

What is a mobile banking app?

Mobile banking app is a mini version of your offline bank in your gadget. With such an app you can conduct any banking activity you need: check bank accounts, monitor your payments, conduct transactions, pay utility bills, book train/flight bills, get brief reports and notifications, etc..

What are the main mobile app development stages?

You should start with deep discovery and planning. The next step is to take into account all the security issues to make it possible to take them into account during development. Then you need to create a catchy and user-friendly UI/UX design. After that, you move into the development phase. The last but not least step is to ensure integration with third-party platforms that are required to provide your users with the best possible experience. After the product is delivered, the maintenance phase starts.

How much does it cost to create a mobile banking app?

It’s hard to say for sure. Everything depends on your needs, variety of features, set of chosen technologies, design specifics, etc. Based on different research, development costs can start from $10 000 and vary to $1 000 000 and higher.