Lending Software Development By Perfsol

Perfsol

Lending Software Development By Perfsol

When it comes to lending software development, picking a professional service provider is on the agenda. Welcome to Perfsol – a Ukrainian-based company specializing in full-cycle software development for a wide range of clients. See what we have to offer regarding lending software development and why we are your perfect partner!

Lending Software Development Services

Perfsol team is dedicated to excellent results. Therefore, we carry out a full cycle of lending software development to give our clients a piece of mind the project will be ready according to their requests and discusses deadlines.

IT Consultation

Tell us about your needs, budget, and expected outcome and we will develop a detailed analysis of all possible ways to implement your project. It’s okay if you’re still uncertain about certain points. With us, there’s no need to have every detail figured out to get going.

Lending Software Ui/Ux Design

Development of intuitive lending software design to promote smooth user interaction with software. We carefully map out the user journey, so you can be sure every button is in its place.

Lending Software Development

We write a code, test, and optimize a lending software keeping in mind its purpose and desired functionality. At this stage, our development team goes above and beyond to foresee and eliminate all issues that may stand between users and the final product.

Loan Software Integration

We integrate loan software into your company with attention to all your business needs and internal processes.

Support & Maintenance

Our lending software development services include handling the issues related to post-release maintenance. We make necessary updates, solve bugs if necessary and ensure the vitality and competitiveness of a product in the long run.

Lending Software Development Company Perfsol

Perfsol is a team of thinkers, builders, and creators that have been delivering fintech software development projects for 4 years. Our development team encompasses creative designers, developers, meticulous testers, and responsive project managers who work to deliver outstanding results. We carry out our work so you can profit from the final product and receive an excellent customer experience throughout our cooperation!

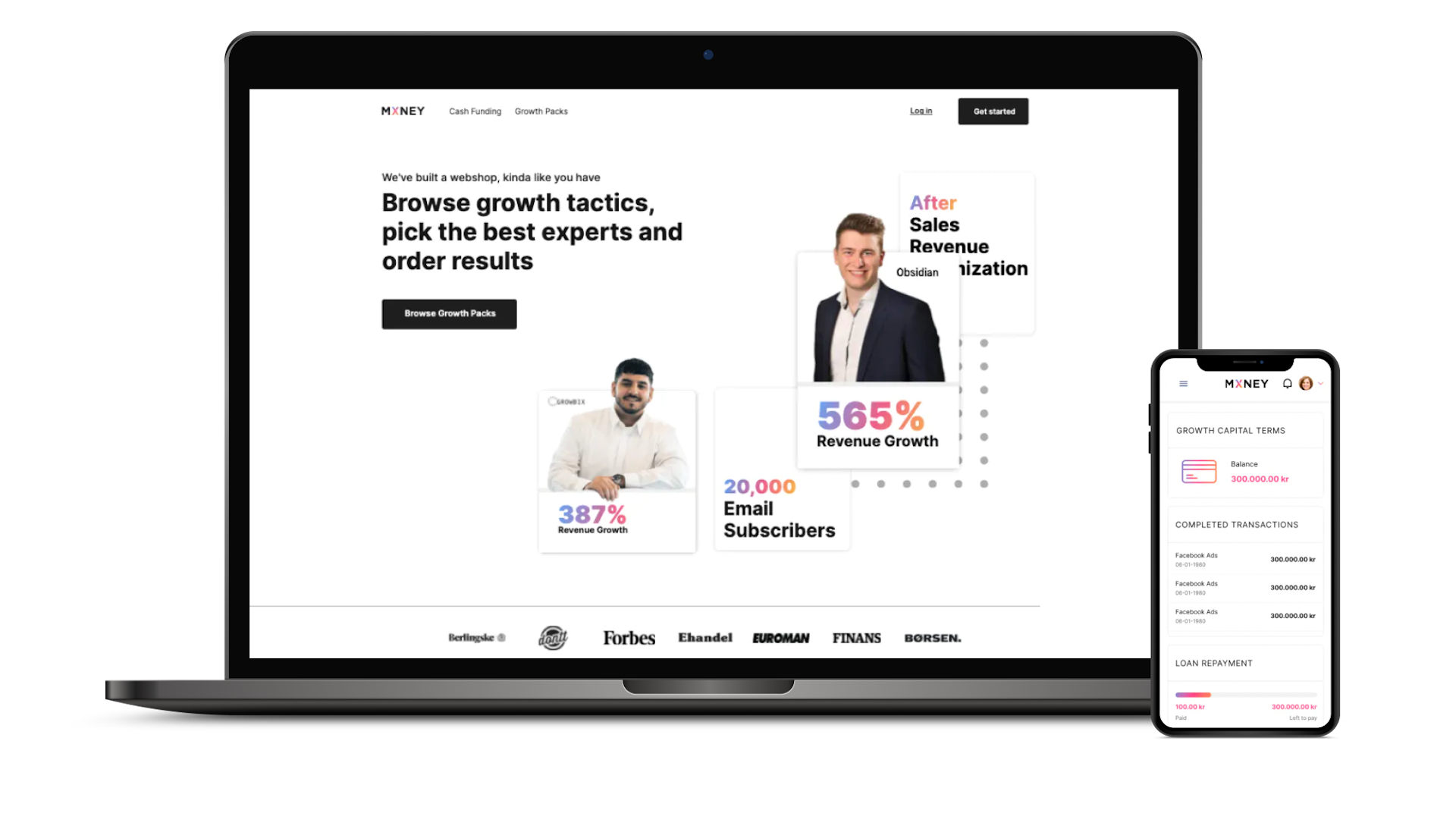

Christian Madsen

Head Of Technology, MXNEY

The client's development scalability and speed have increased thanks to Perfsol's quality work. Their commitment to understanding the business needs has been key to reaching the expected goals.

Shahar Mintz

Director of Web Engineering, Riverside.fm

Delivering multiple web technologies, Perfsol is a consistent and dependable partner. Their communication stands out as excellent compared to outsourced competitors, interacting over Slack and Jira.

Why Develop Lending Software with Perfsol

Perfsol is proudly standing out in the realm of lending software development. Whether you're in the market for p2p lending software, lending management software, loan origination software development, or any other lending software solution, choosing the right development partner can make all the difference. That's where we come in. In the following paragraphs, we're surfacing why developing lending software with Perfsol is the best choice for your lending business.

Vast fintech experience

Our team has worked on numerous lending software projects, gaining insights and expertise in the industry's nuances. This experience enables us to create lending software solutions that are not only technologically advanced but also tailored to the specific needs of your lending business.

Full-cycle development

From conceptualization to design, development, testing, and deployment, we're with you every step of loan management software development. Our end to end lending software solutions ensure that you get a comprehensive product that meets your requirements, saving you time and effort in coordinating with multiple vendors.

Flexible cooperation models

Perfsol offers flexible cooperation models tailored to your specific needs. Whether you need our expertise for a short-term lending application software project or a long-term partnership for ongoing support and development, we outstaffing and outsourcing opportunities offer the flexibility you require.

Security and regulatory compliance

Perfsol takes security and regulations seriously. We incorporate robust security measures to ensure that your lending software solution complies with all relevant regulations. With our lending software, you can operate with confidence, knowing that your data and operations are secure and compliant

Agile approach

The lending industry is constantly evolving, and your software needs to keep up. Perfsol follows an agile development approach, allowing us to adapt to changing requirements and market dynamics swiftly. This ensures that your lending software remains up-to-date and competitive.

Proficiency with microservices

In the modern lending ecosystem, microservices architecture has become a game-changer. Perfsol excels in the development of microservices-based lending software solutions, which offer scalability, flexibility, and improved performance.

Custom Lending Software Solutions By Perfsol

At Perfsol, we are experts in a variety of bespoke lending software solutions development. Here are the types of loan lending software we develop for your business.

P2P Lending Software

P2p (peer-to-peer) lending software connects needy businesses or individuals with a lender without an intermediary - mostly traditional banks with their perplexing procedures. P2p lending software is associated with lower interest rates compared to bank lending, easier access to funds, and higher returns on investment.

Loan Management Softwar

Loan management software is designed to automate and facilitate every stage of the loan lifecycle from application to paying the debt. The process involves not only calculating interests and supervising payments but also the provision of detailed analytics for lenders and borrowers.

Document Management Software

Document management software development is a step to a paperless future. Document management software is designed to capture, track and store paper-based content in digital format.

Crowdfunding Software

Crowdfunding software connects fundraisers and the crowd willing to invest small capital into a campaign. Crowdfunding software charges a fee from fundraisers in case the fundraising campaign was successful.

Loan Origination Systems

Loan origination systems (LOS) development is called to automate and manage the end-to-end lending process for banks and credit unions. LOS aims to facilitate and speed up the entire lending procedure, mainly reducing the need for human intervention and minimizing human errors.

Our Lending Software Development Projects

A perfect lending software solution by Perfsol is the result of creativity, proper technology use, and the inspiration we get with the first sip of caffeine in the morning. Our portfolio is the most vivid confirmation of our expert knowledge and experience in bespoke landing software development. Check it out!

Global Distributed System integration

Perfsol designed architecture that conforms to Amadeus standards. For a traveller, the system allows searching by airports, cities and looking for round trip flights.

Promis: Invoicing software screens redesign

We have redesigned the app to display invoices and manage sales more effectively in real-time.

MXNEY: Financial App For Ecommerce

We have developed a feature-rich application to take financial management to a whole new level.

Homeease.pro: SaaS for real estate development

Combining the insight of a local agent, the algorithms of an auto-pricing website, and the calculations of appraiser, HomeEase was created to give everyone access to the most accurate method for home pricing.

FAQ

Who does Lending Software Development Consist of?

Lending software development is a blend of talented team members specializing in project management, UI/UX design, frontend and backend development, quality assurance engineers, and post-release support managers.

How Much Does It Cost To Develop A Money Lending App?

Money lending software development cost is never set. It depends on the range of factors that directly or indirectly impact the final cost. In general, lending software development takes around $40.000.

How to Reduce the Cost and Speed up Lending Software Development?

To reduce the cost and boost the time-to-market lending software delivery, it’s enough to apply for an Eastern European development team like Perfsol. We carry out full-cycle development, meaning our team is always in touch. Besides, our location allows us to charge lower rates for equal quality compared to Western development teams.