Table of contents

The introduction of mobile banking was a tectonic shift in B2B and B2C financial services. The idea of performing financial operations from smartphones had a colossal impact on business practices and revenue streams. Embedded finance holds the same — if not bigger — potential. The ability to provide financial services from within non-financial products and apps opens immense business opportunities.

Big Tech and small enterprises alike are actively exploring this field. Apple Pay, Google Pay, and various BNPL (Buy Now, Pay Later) platforms are just the tip of the iceberg. Embedded finance can combine disparate products and services into a user-centric ecosystem with great customer experience — while generating uncountable revenue streams that simply were not possible before.

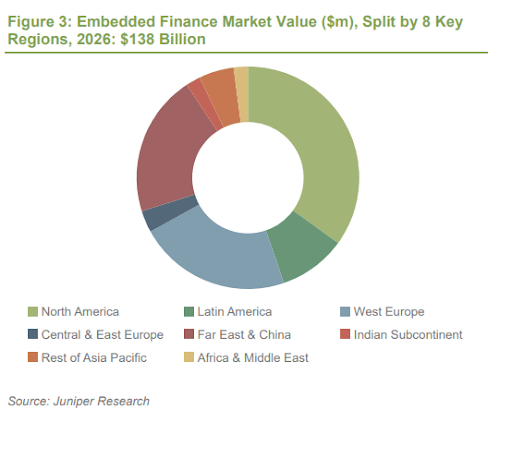

These factors contribute to the stable growth of the embedded finance market. According to Juniper Research, it will grow from $54 billion globally in 2022 to a whopping $138 billion by 2026. Most of the market will be concentrated in the US, Canada, EU, and China.

Perfsol has ample expertise in designing, building, and integrating embedded finance solutions for businesses of any scope and across business industries — from MXNEY.io, a one-stop-shop for all financial services for eCommerce, to Transformify — a global workforce management and remuneration platform working with multiple eWallets and 20+ cryptocurrencies.

This article will briefly overview what embedded finance is, the success enablers it can provide for your business, the challenges you can meet along the implementation journey — and how Perfsol can help address these challenges.

What is Embedded Finance?

Embedded finance can be defined as an integration of traditional financial services (payments, lending, insurance, banking, and more) into traditionally non-financial user experiences (like eCommerce, gaming, food delivery, subscription services like Spotify or fitness clubs, etc.).

As a result, customers gain the ability to pay for a product or service in one click, apply for a micro-loan with BNPL services like Klarna, or automatically insure their car (when ordering a Tesla). And we’ve barely scratched the surface with embedded finance opportunities.

The most common use cases for embedded finance are as follows:

- Payments. One-click checkout with a digital wallet like PayPal or Google Pay is enabled by Open Banking API integration, where a digital wallet holds all the customer’s financial credentials and verification data, so it really takes one click to make a payment.

- Lending. BNPL platforms are actually lenders, as they pay the item cost upfront to the merchant. This allows clients to use the product or service and repay its price in several installments — a service banks have been traditionally providing.

- Investments. Many eCommerce shops offer to automatically round up the purchase, so the customer builds a kind of investment portfolio over time with the platform and can use these funds at the earliest — without actually withdrawing funds from their banking card.

- Insurance. We are so used to electronics vendors offering guarantees with their products that we barely notice it. But this is actually an example of embedded insurance, creating an additional revenue stream for vendors while improving customer experience.

- Banking. Brex virtual corporate cards tied to a single account, debit cards from Wise (which initially was just a money transfer platform), or Uber/Lyft driver banking services — all of these are examples of embedded finance enriching other business verticals.

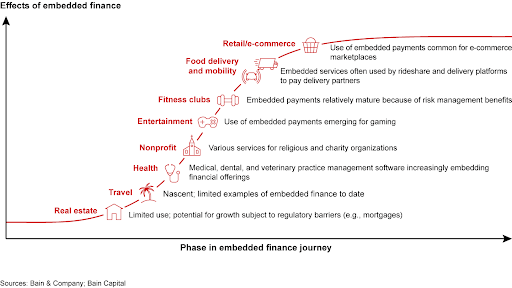

According to the Bain Capital research on embedded finance effects, various business verticals have different degrees of embedded finance maturity. Still, all of them are working on maximizing the potential of this approach:

Source: Bain Capital

Due to the proliferation of Open Banking APIs and the convenience of the BNPL approach in eCommerce and other domains, embedded finance opens an immense field of possibilities for any business in any industry. Plaid and Accenture survey highlights that 88% of companies reported increased customer engagement after implementing embedded finance in their value chain.

Success Factors of Embedded Finance

Benefits like increased customer base, additional revenue streams, cross-selling, and up-selling might seem self-explanatory. But there are several key factors to account for if you want to get the most value from any product with embedded finance.

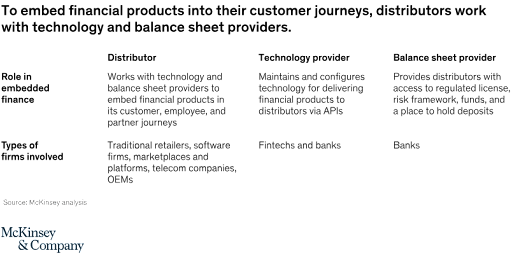

- Who distributes the offer? Embedded finance only works when it helps streamline the customer journey — so customers, employees, and partners must be exposed to these offers. This is usually done by retailers, eCommerce marketplaces, telecom companies, and other entities.

- Who provides the technology? Some fintech startups should act as an intermediary to help overcome the limitations of traditional technology used by distributors — and actually embed financial offerings into their customer experiences via Open Banking APIs.

- This is where your company most likely comes in — providing the technological know-how to bridge the gap between distributors and balance sheet providers.

- Who manages the balance sheets? Embedded finance facilitates the money flow, but the money must still come from one banking account to another, which involves regulatory compliance, risk management, fraud prevention, and actual infrastructure for holding the deposits.

This role is traditionally performed by banks.

Source: McKinsey Company

It might seem a pretty straightforward scheme — until you take in the challenges to overcome.

Challenges of Embedded Finance Implementation

There are some psychological and technological roadblocks that must be solved for embedded finance to truly flourish.

Outdated mindsets

Banking institutions are used to being cornerstones of financing — approving or denying loans, dictating interest rates, and enabling investment. With embedded finances, they lose this role as they become just an infrastructural backbone for a much wider ecosystem and not the key player in it anymore.

For insurers, the problem is similar: they no longer control the market singlehandedly but rather come as a side service, even though for a much wider range of offers.

Decreasing the importance of a position can be a hard pill to swallow, but not doing so poses a huge risk for incumbents, as more technically savvy fintech startups can partner with other banks and financial institutions. Alternatively, they can build independent technology platforms, which leads us to the second challenge.

Immature technology

Open Banking APIs, payment APIs, BaaS offers, and BNPL popularity have all grown enough to enable the proliferation of embedded finance. But they are still dwarfed by the scope of resources and infrastructure traditional banks possess. While fintech startups can adapt to changing customer preferences better and innovate faster, they still lag behind banks in terms of infrastructure capacities needed to support embedded finance offerings at scale.

This problem will be solved one way or another, as Oracle predicts the embedded finance market to be worth $7 trillion by 2033, greatly surpassing the joint evaluation of the world’s 30 biggest banks. But collaboration is much more preferable and easier than competition; otherwise, fintech companies will have to build infrastructure comparable to that of incumbent banks while rendering the existing infrastructure useless.

Therefore, as a technology enabler, a fintech startup must find common ground with banks and distributors while overcoming technological limitations. The key roadblocks on this way are listed below:

- Future-proofing the existing tech. Building payment API connectors or using Open Banking APIs to allow outdated bank infrastructure to interact with the latest tech used by distributors across multiple business verticals.

- Process automation. Every aspect of the customer journey should be transparent, traceable, and repeatable to minimize overhead. Automation is the key to ensuring the scalability of services.

- Quality of the product. Ensuring cohesive interaction of banking infrastructure with eCommerce platforms, travel booking aggregators, logistics engines, and other software solutions can be hard. The urge to use quick and dirty fixes will be great — but such workarounds can seriously deter future product scalability and quality.

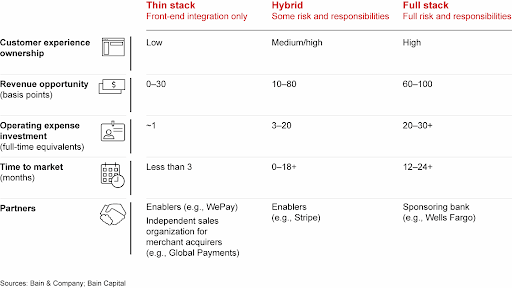

For instance, simply integrating an embedded finance solution with a product front-end can be done in less than 3 months but will yield low revenue opportunities. On the other hand, building a full-stack product integrated with platforms across multiple verticals can take up to 24+ months and entail a significant risk — but will bring 3 times more revenue opportunities. Therefore, taking a middle route by building connectors for existing payment providers like Stripe can yield optimal outcomes.

Source: Bain Capital

Price, Flexibility, Speed

The longer the project takes to deliver and the more features it has, the more it costs. However, the industry is evolving rapidly, so any product development must be aligned with current trends and up-to-date customer preferences to ensure the product is relevant and drives value after release.

Finding the right developer in-house

Both fintech companies and banks might struggle to attract and retain talent with a sufficient visionary mindset to correctly visualize, design, and implement a reliable, highly performant, and scalable embedded finance solution.

Partnering with the wrong service provider

The decision to outsource the task to a third-party service provider might be the logical outcome of the previous point. But the choice of such a company can make or break the project — or at least cost a lot of time on the way to successful delivery.

Deep tech experience in a specific area

One of the key challenges is ensuring the technology partner actually has sufficient expertise across a variety of domains to devise and build a multi-facet solution needed for an embedded finance platform.

Lack of time

Last but not least is the need to deliver on time — or the product risks falling behind, with more tech-savvy upstarts who entered the field a few months sooner cutting the slice of the market.

As you can see, selecting the right technology partner with sufficient technical background is one of the key decisions enabling successful embedded finance project completion.

Why Perfsol?

With a solid background in fintech development, Perfsol is housing 30+ top-quality experts. Our depth and width of business analysis enable us to explore all the possible project implementation strategies and suggest approaches that deliver the most value to our clients.

We take pride in being named Top Plus developers on Upwork, one of the top B2B Service Companies in Ukraine in 2021 and 2022, and a Top App and Software developer on Goodfirms.

Having more than 50 fintech projects under our belt, we accumulated a trove of knowledge on the latest fintech trends and developments. And our dedication to quality is what drives us in every project, enabling our clients to deliver maximum value to their customers.

Conclusion

Embedded finance has reached a point where both Big Tech companies and fintech startups can reap its benefits. By weaving traditional financial services into non-financial customer experiences, embedded finance enables much smoother and more streamlined payments, generating additional revenue streams and creating new business models.

However, implementing such solutions correctly requires solving multiple challenges — from overcoming outdated mindsets of banking institutions to selecting the best technology stack and product architecture to support reliable and sustainable growth. The choice of technology provider is paramount to ensure successful project completion.

Perfsol is ready to lend a hand and help you build feature-rich, secure, and scalable embedded finance offerings for your customers. From product design to team extension, software development from scratch, or ongoing maintenance and updates — Perfsol can support you at any stage of the software lifecycle.

Contact us for a free consultation, and let’s see how we can help you provide embedded finance services!

Author

CEO

I follow a proactive approach in life to solve simple to complex problems systematically. I fully understand the nexus of people, process, technology, and culture to get the best out of everyone at Perfsol to grow the businesses and deliver a societal impact at the national and global levels.

FAQ

What are Embedded Finances?

Embedded Finances refer to the integration of financial services into non-financial products or platforms, enabling seamless and convenient transactions for users. It involves incorporating payment processing, lending, insurance, or other financial functionalities directly into existing applications or devices.

What are the benefits of Embedded Finances for businesses?

The benefits of Embedded Finances for businesses include: Enhanced customer experience: By offering financial services within their platforms, businesses can provide a one-stop solution for their customers, reducing the need to navigate multiple platforms for transactions. Increased user engagement: Integrating financial services into products can boost user engagement and retention, as customers are more likely to stay within a platform that meets their diverse needs. Additional revenue streams: Companies can generate additional revenue through commissions or fees earned from financial services offered on their platforms.

What are the challenges associated with implementing Embedded Finances?

Some challenges related to implementing Embedded Finances are: Regulatory compliance: Offering financial services may require businesses to adhere to complex financial regulations and obtain necessary licenses, which can vary across different regions and countries. Security and data privacy: Handling sensitive financial information demands robust security measures to protect user data and prevent potential breaches. Integration complexity: Integrating financial services seamlessly into existing products can be technically challenging, requiring collaboration with financial institutions and specialized fintech providers.