Fintech Mobile App Development: How to Create a Fintech App and How Much Does it Cost

November 27, 2022

Mobile development

FinTech

Table of contents

Fintech mobile applications continue bringing financial services closer to customers, helping them rethink traditional eCommerce, payments, banking, and finance management. In this article, we’re uncovering the top trends in development of fintech mobile apps that are either moving to the following year or will appear as a hot must in 2023. You will also learn what to pay attention to in order to make fintech application development worth your time and money.

Fintech App Development Market Overview

The role of digital technology in the financial sector is growing rapidly and numbers illustrate that. Only a year ago, in 2021, the financial technology market was estimated to be worth roughly 112.5 Billion USD. Up to 2026, it’s predicted to reach approximately $324 billion.

Financial technology is adopted globally with North America and China taking the lead as the most popular locations for fintech startups. In fact, there are roughly 30,000 fintech startups on the market in 2022 and the year is not over yet.

Obviously, the industry of fintech mobile apps is blooming, which however doesn’t mean there’s no place for your product. So let’s see how to make your fintech app development a promising venue.

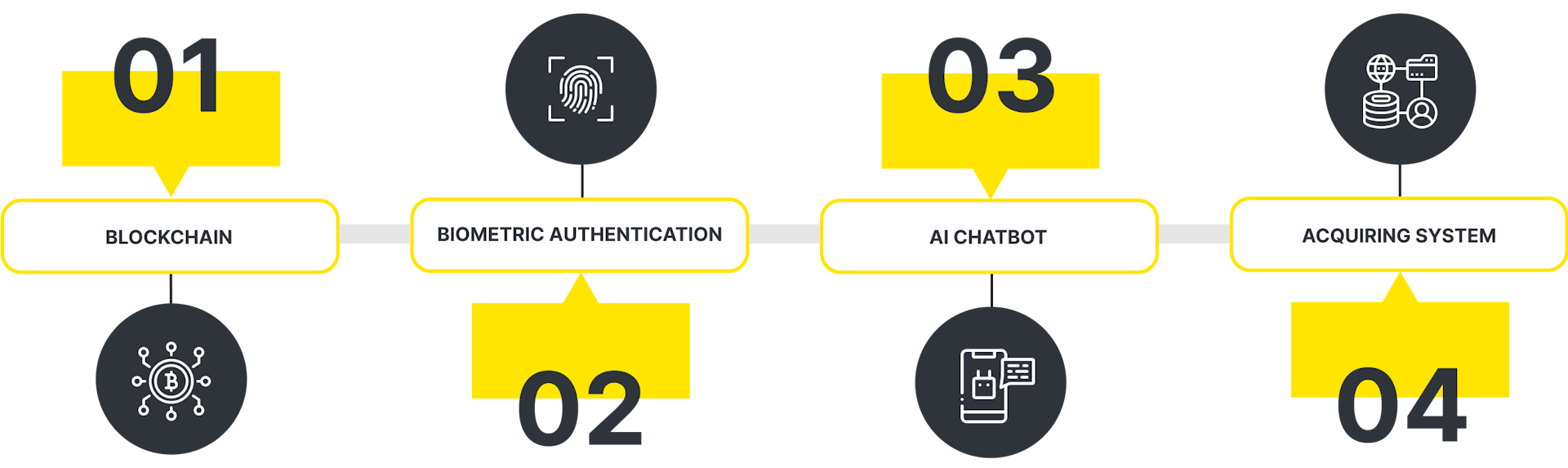

Top Trends in Fintech Mobile App Development

Take a look at top factors to emphasize while building a fintech mobile app.

Blockchain

Blockchain is an emerging technology of fintech software development, the point of which is to allow digital information to be recorded and distributed but not altered, deleted or destroyed. In fintech mobile app development, blockchain helps to integrate secure payment getaways, identity management, and protection, and eliminate third-party involvement to boost the process and make financial technology error-free and secure

Biometric Authentication

As the fintech mobile app industry is sensitive when it comes to user privacy, biometric authentication is a must for development of fintech mobile apps.

Biometric authentication which can be either face verification or fingertips recognition is one of the most reliable techniques for identifying a user. This is how the fintech mobile app will manage to keep users’ financial and personal data secure.

Apart from being a beneficial tool in the provision of ultimate security, biometric authentication eliminates the need to fill in passwords any time a user logs in. The thing is, the low friction in fintech mobile app is a key for seamless user experience.

AI Chatbot

Computer systems that simulate interaction with a human agent are widely used across different industries, and fintech mobile apps are no exception. AI chatbots often act as customer support agents that answer uncomplicated questions via instant messenger (f.e WhatsApp, Google Hangouts, Telegram, Facebook Messenger, etc.).

AI chatbots for mobile apps work as informational, transactional, or advisory assistants. With AI chatbots, users can perform simple actions like checking their balance, requesting bank statements, etc.

Acquiring System

With the emphasized focus of fintech on transparency and security, acquiring systems is emerging as one more trend in building a fintech mobile app. Every time a user initiates payment by submitting their credit or debit card details, acquiring systems send a payment request to users’ bank via a network of card schemes. If payment is authorized, acquiring system retrieves funds. If payment fails, it reports a reason.

Acquirers must receive a license from local regulatory bodies which is often a long and complex process. This is why businesses prefer to establish connections with acquiring system providers to process payments for them in exchange for a transaction fee.

Fintech Mobile App Development Cost from Perfsol

Speaking of fintech app development cost, let’s review the real case example of building fintech mobile app by Perfsol programmers to get the real numbers. Perfsol has been recently working on MXNEY — a loan lending app.

MXNEY is a promising fintech mobile app created for eCommerce entrepreneurs to find a transparent source of funding. The cost to build the application consists of two main parameters, namely the number of hours a specialist spent dedicating to a project and their hourly rate, which is $40 per hour. To build MXNEY, Perfsol engaged the following development team:

- Front-end - 240 hr/mo

- Back-end - 240 hr/mo

- Project manager\business analyst - 80 hr/mo

- UI/UX - 80 hr/mo

- QA - 80 hr/mo

- DevOps - 80 hr/mo

This brings the end cost of fintech application development of $30,000. The figure is based on the rates of Ukrainian fintech mobile app developers. Western tech specialists will charge twice as much, which will double the final fintech app development price but leave quality untouched.

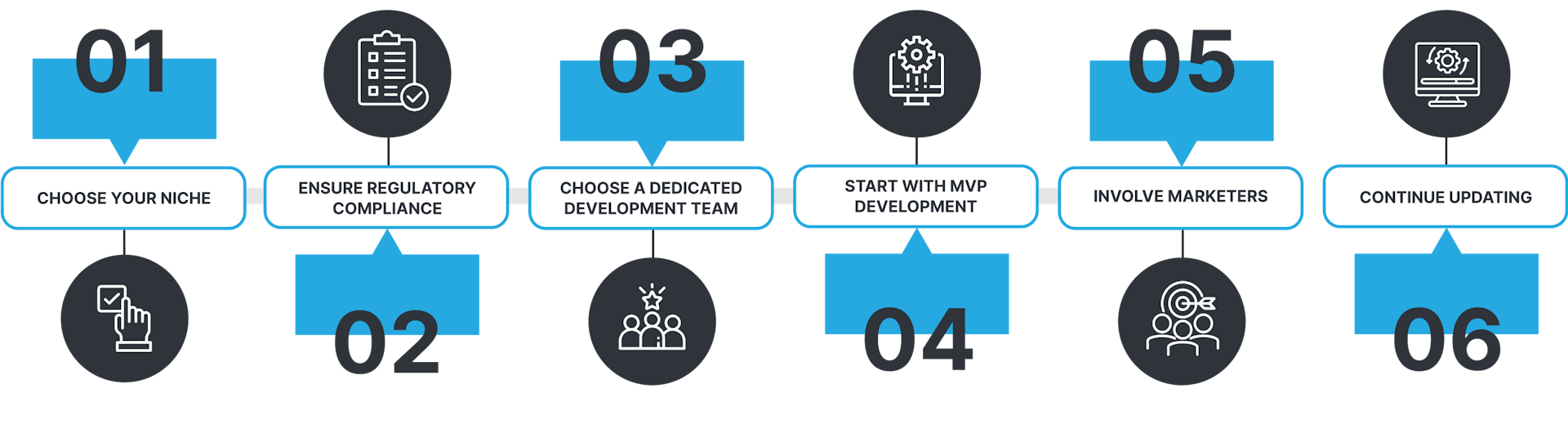

How to Create a Fintech Mobile App: Top 6 Recommendations

Building a solution that will resonate with the needs of your TA is one of the primary goals of fintech mobile app development. We prepared a few key suggestions on how to build a valuable and competitive fintech mobile app. Check them out!

Choose Your Niche

Decide on the type of fintech mobile app you’re going to build. This can be a money landing application, insurtech solution, online banking, or personal finance management application. Depending on the type of fintech mobile app, research your target audience to figure their needs and research the market of your direct competitors.

Ensure Regulatory Compliance

Regulatory compliance in financial sector is hooked on data protection and anti-fraud. In fact, common compliance factors for fintech mobile apps are GDPR (general data protection regulation), AML compliance (anti-money laundering), KYC compliance (know your customer), digital signature certificate, and PCI DSS (Payment Card Industry Data Security Standard). There can be even more differing from country to country.

Choose a Dedicated Development Team

Once you’ve chosen the venue for your fintech mobile app, it’s time to start looking for a team to bring it to life. They manage core technical responsibilities such as the design, development, and testing of a fintech mobile app. Choose any convenient cooperation model e.g. in-house team, outsourcing, or outstaffing to get going.

Start with MVP Development

MVP is a basic sample of a platform that contains all must-have features to let a fintech mobile app cater to the needs of the target audience. The point of launching MVP is to validate the market idea, test the UI, and test the early fintech mobile app performance by gathering feedback from early adopters. Besides, a clickable MVP serves as a tool for attracting investors for startups that can’t sponsor fintech mobile app development independently.

Involve Marketers

The great share of fintech mobile app development success is a talented team of developers. Marketing effort, however, should not be underestimated. Marketers are responsible for attracting and retaining a loyal audience to your fintech mobile app as well as helping it retain positions in the competitive market.

Continue Updating

After your fintech mobile app is released to the audience, you can exhale… and proceed to analyze its performance. Fintech application development is an everlasting process that also involves the provision of high-level technical support, tackling bugs, and making necessary updates. Post-release support will ensure your app is able to deliver value to its target audience remaining user-friendly over time.

Author

CEO

I follow a proactive approach in life to solve simple to complex problems systematically. I fully understand the nexus of people, process, technology, and culture to get the best out of everyone at Perfsol to grow the businesses and deliver a societal impact at the national and global levels.

FAQ

How long does it take to build a fintech app?

It all depends on the type and desired functionality of a fintech mobile app and the capabilities of a development team. It takes nearly 2 months to create a simple fintech mobile app, while building a more complicated platform will take around 4 months.

Can I launch fintech mobile app without MVP development?

Yes, it’s normal to launch a fintech mobile app without a prior MVP release. However, testing the waters with MVP first may result in saved time and budget since you make sure you don’t invest in the development of a fintech mobile app with zero functionality.

What team does it take to develop a fintech mobile app?

Fintech application development takes a team consisting of a product manager, UI/UX designer, back-end and front-end developers, testers, and marketers. For a smooth and time-saving creation process, it’s better if all these roles are taken by members of one development agency.