Loan Lending App Development: How Much Does it Cost to Create a Loan App in 2022

August 10, 2022

Development

FinTech

Table of contents

In 2022, fintech applications remain an efficient tool in the provision of financial services and personal financial management. Loan lending apps are the essential type of fintech apps, designed to facilitate the loaning process. This page is dedicated to enlightening curious readers about every aspect of loan lending app development, namely the different types of loan lending apps, development stages, and the creation cost.

Loan Lending Apps: What Are They?

Before delving into details, let’s nail down the definition of loan lending software and their current position in the fintech scene.

P2P loan lending apps are a type of fintech application designed to facilitate the lending process. This is achieved by immediately connecting the borrower and lender directly without the need for mediators, banks, or credit unions.

Loan lending apps cover the entire lending process from the loan application to payday.

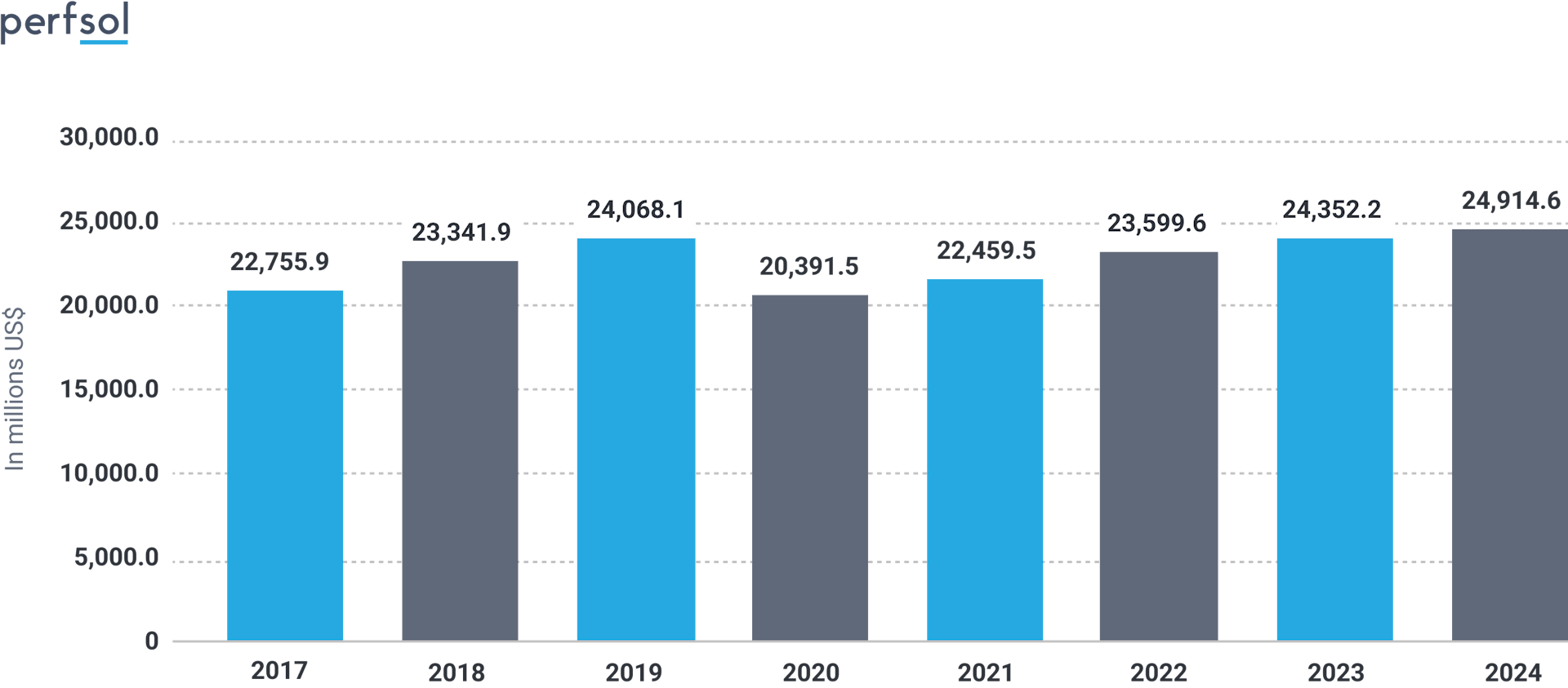

The number of loan lending mobile applications is steadily increasing. However, there are many reasons why this is the right time for P2P loan lending app development. Statista predicts that the loan lending market will face significant growth in the next two years. By 2024, the mobile app loan market will reach USD 24,914 compared to 20,391 in 2020 and 23,599 this year. See the graph below.

5 Types of Loan Lending Apps

Depending on the type of loan, there are at least five types of specialized applications you may consider developing. Here they are:

Student Loans

These apps target a specific audience of borrowers who mainly need to cover their educational costs. Student loan apps are a popular type of loan landing application that can be delivered by a creative and professional fintech app development team with ease.

Home Loans

Home loan application development is perfect for those who want to help people with mortgages. If you invest in the fintech software development of a user-friendly solution, people are likely to spread the word about it.

Vehicle Loans

By developing a vehicle loan-lending app, you can help people cover the costs of essential joys such as acquiring a vehicle.

Business Loan

This caters exclusively to businesses or startups in need. If you want to help individuals with setting up or developing their business, opt for developing a business loan application.

Personal Loan Mobile App

This is the broadest popular type of loan and thus the most attractive to lenders. These are loans obtained for personal use. Personal loan app development is often associated with higher interest rates and more profit.

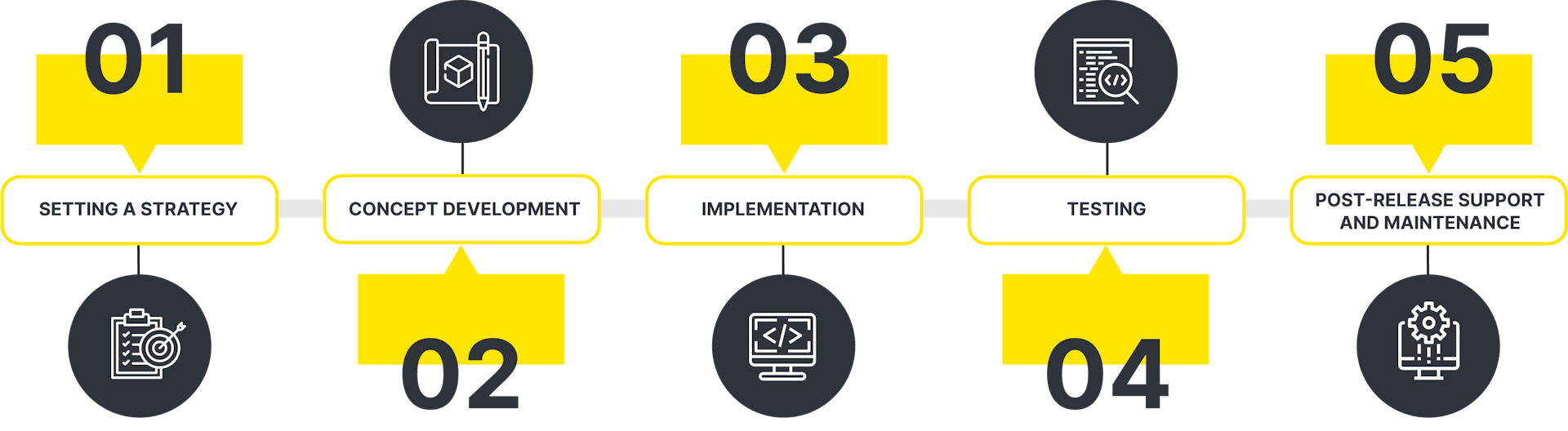

Lending Software Development Stages

Now let’s discuss the fundamental stages in the development of a loan lending app. Here is the procedure that a professional development team adheres to for creating fully-featured software:

Setting a Strategy

A development team relies on your product suggestions or helps you to originate one. A strong idea incorporated with the knowledge and expertise of a programmer team is fundamental for the development of a loan lending app that will generate significant profits.

Concept Development

UI/UX designers build an application interface that will work perfectly for your business. The concept developed largely depends on the type of application being built and your TA.

Implementation

Utilizing the most appropriate technologies to fit the features and functionality required, a programming team will turn an idea into a turnkey loan giving app.

Testing

The purpose of testing is to make sure the final product is bug-free. Only serious errors in loan lending app development can be fixed at this stage.

Post-release Support and Maintenance

After the application finally reaches the audience, it’s essential that free support and supervision are provided. This is not only the best way to launch your product on the market, but also guarantees its continuous performance.

Apart from the technical aspects we covered, there are also essential legal compliance and encryption issues to consider before initiating development. These are GDPR compliance, Ensuring Fault Tolerance, CCPA Compliance, and, in the case of loan lending app development for Californian users, Security prioritization.

Loan Lending App Development Costs

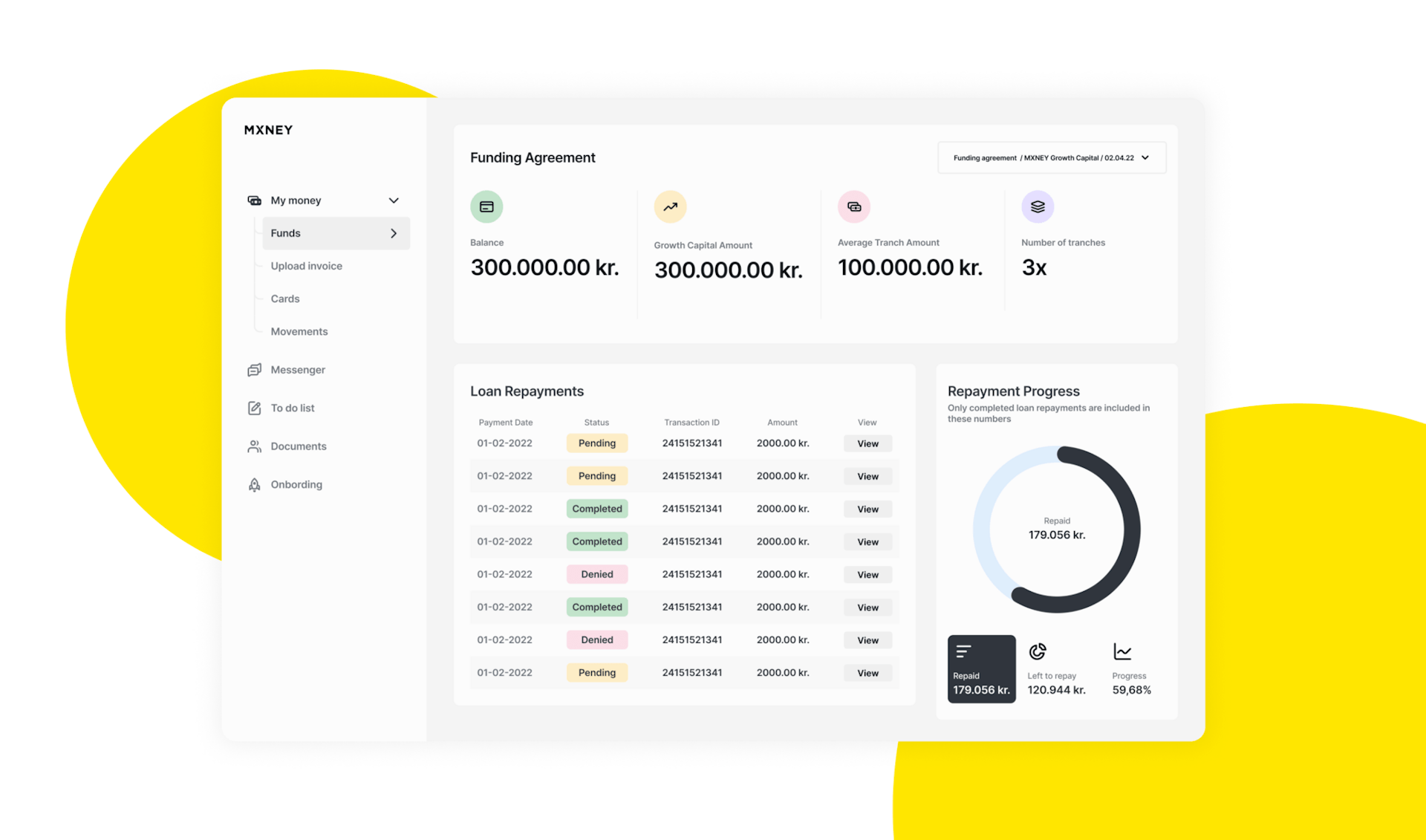

If you want to know the cost of developing a loan lending app, the most illustrative thing would be demonstrating one of our previous projects. It was a multifunctional fintech project and our specialists did their best for it. Now MXNEY is a promising fintech startup that offers non-dilutive flexible growth funding for eCommerce entrepreneurs. It allows founders to raise funds without giving up equity.

Specifically, we needed to:

-

Create a platform that consists of the client's dashboard, admin side, and messenger.

-

Ensure the client part will have a dynamic, informative dashboard that allows them to track their expenses and loan payments, create virtual cards and interact with existing bank accounts.

-

Make the dashboard collect metrics and data from Google Ads, Google Analytics, Facebook business accounts, and different web-shop platforms like Shopify, Woo-commerce, SmartWeb, etc.

Now let's understand how much it costs. So, the cost of an application is made up of two main parameters, namely the number of hours spent on its creation and the price of an hour of work of a specialist. If you order the development of a lending app in Ukraine, the rates of local specialists will be around $40. As for the cost in terms of time, it went as follows:

- FE: up to 240 hr/mo

- BE: up to 240 hr/mo

- PM/BA: up to 80 hr/mp

- UI/UX: up to 80 hr/mo

- QA: up to 80 hr/mo

- DevOps: up to 80 hr/mo

This brings the figure to $30,000. At the same time, if you order a similar application in the U.S. or Western Europe, its cost can be easily multiplied by two. So, if the average price for a specialist in the U.S. is $80-100 per hour, the cost of such an application will grow to $50 000 -$70 000. Meanwhile, the quality will be exactly the same. The conclusion is simple, you need to turn to trusted companies from Ukraine immediately and to get a reliable technological partner, which will allow your business to reach a whole new level.

Depending on the scope of work, the technological model, and the development team, we can estimate the approximate final development cost. On average, the price of loan lending applications starts from $30.000 and can reach a whopping $84.000.

Top Tips on Reducing Loan App Development Costs

Not every financial startup is willing to spend vast sums on application development. Thus, if you are wondering how to get a game-changing loan lending app at a reasonable price-quality ratio, the following tips are for you. Please notice that we aren’t considering the extreme ways of saving here and do not suggest sacrificing quality for reducing the price tag.

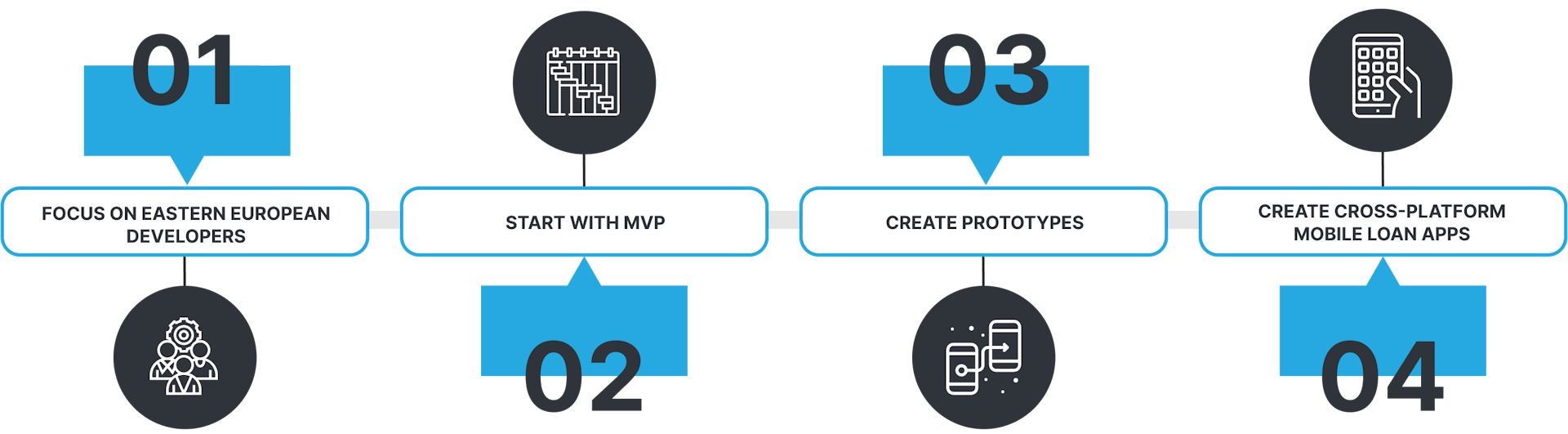

Focus on Eastern European Developers

The location of the loan app development team is one of the major contributors to the final cost of the software. When it comes to saving money, we suggest outsourcing to Eastern Europe for the best outcome for an optimal price.

Start with MVP

You don’t necessarily need to opt for every single feature that you think might be useful for end customers. Starting with an MVP (minimum viable product) of a micro lending app to help you test the waters before creating the final version of the application. This is how you’ll see what features satisfy the needs of your TA and what extras can be added later.

Create Prototypes

The creation of a clickable prototype is one of the best ways to keep costs down. Ask designers to dish out a clickable prototype that will showcase the flow of your app. This will show whether a loan lending app is right for development before you actually start investing in it.

Create Cross-Platform Mobile Loan Apps

Every entrepreneur wishing to launch a mobile app faces the dilemma of whether to launch an application for iOS or Android or both. The best way to save money, in the long run, is to create cross-platform software from the start.

Author

CEO

I follow a proactive approach in life to solve simple to complex problems systematically. I fully understand the nexus of people, process, technology, and culture to get the best out of everyone at Perfsol to grow the businesses and deliver a societal impact at the national and global levels.

FAQ

What team is needed for loan lending app development?

Creating a loan lending app takes a team of marketers, designers, programmers, and testers. It’s always better if all these roles are taken by the members of one development team for a smooth and fast development process.

How much does it cost to develop a money lending app?

In general, it costs around **$30.000** to develop a money lending app. However, the final cost may vary depending on the complexity of the project, the scope of work, and the location of the development team.

How can you reduce the costs and boost the speed of lending app development?

Using Eastern European development team and starting with MVP development are good ways to reduce the cost and time spent on loan lending app development. The creation of a cross-platform product is another great option for reducing the final cost and time frames.