How to Develop a Fintech App and How Much Will It Cost?

August 10, 2022

Development

FinTech

Table of contents

The market for fintech apps is expanding, with companies introducing the latest innovations: AI, ecosystems, and paperless services. These sophisticated options make people's lives easier. KPMG reports that fintech investment in the first half of 2021 reached $98 billion. And judging by the news, venture capital funds are not going to slow down. Between classic banks and non-banking startups, global ecosystems, and highly specialized apps, the battle for the consumer continues. In order to win and retain users, it is no longer enough to meet the demands, it is necessary to look into the future and anticipate industry trends. In this article, we will tell you how to make a technologically advanced and user-friendly fintech app, what you need for that, and what trends are popular with developers in this direction right now.

Review of fintech app development market

The fintech sector showed some impressive moves in 2023. Looking ahead to 2024 and beyond, the scales are expected to tip even more, according to the stats from various analysts. For example, based on Boston Consulting Group (BCG) research, fintech revenues could skyrocket six times over by 2030. Currently sitting at around $245 billion, those revenues are projected to hit $1.5 trillion in the next 5-6 years. What's more, the overall share of fintech in the global financial market revenue is set to jump to 7% (from the current 2%).

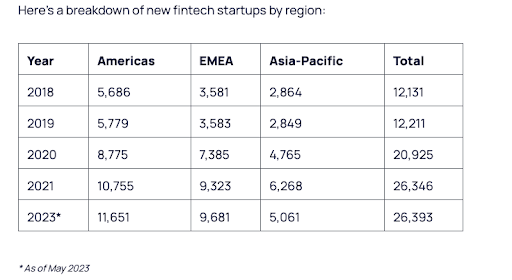

In 2023, the industry saw a sharp rise in new startup appearances. While America took the lead with the highest number of new fintech startups, Europe, the Middle East, and Africa (EMEA) are swiftly catching up. With this trend in mind, we can expect a continued surge in fintech startups in the coming years. Who knows? Build a fintech app and your project might just be the next fintech unicorn!

TOP 3 Mistakes that Make Fintech Startups Fail

Recent stats show that about 90% of new businesses, including those in finance and technology (fintech), could fail. What are the main obstacles that might stop you from succeeding? Take a look at the list below to be prepared for possible challenges and avoid them!

- Lack of market research. Building a fintech app, startups often dive headfirst into their ideas without really checking if those ideas match what users actually need or solve their problems. You could end up with a fantastic product, loaded with cool features and sleek design, but it might not be what the market is looking for. Take a moment to dig into your target audience, scope out the competition, and keep an eye on trends. It might take a bit, but it'll give you the right roadmap for what comes next.

- Failing to plan for scalability and rapid growth. Startups are all about that ongoing quest for growth. So, when you're sketching out your development strategy, it's key to factor in every little hiccup you might hit while scaling up. Set up a nimble architecture building a fintech app, figure out which team members you need to bring on board for smoother operations, identify processes that can be automated to ease the workload, and zero in on the big-picture aspects of expansion.

- Ignoring regulations. Fintech is a specific area, dealing with loads of personal info. So, there are tons of rules, and breaking them can mess up your software big time or even land you in legal trouble. If you're keen on smoothly sailing through your fintech project without getting stuck in legal headaches halfway, it's smart to really dig into the laws that apply to your turf and make sure you're playing by the book. If you're unsure about achieving both technical excellence and legal compliance for your fintech app, reach out to our fintech development team!

Absolutely, this brief list is just the tip of the iceberg. However, addressing these three challenges can go a long way in helping you steer clear of numerous related problems.

Fintech app development: important features

Every fintech app development project seeks to stand out with its unique features. Nevertheless, there are some common trends and technologies that currently have special attention.

Security

The basis of any fintech app is security. The developer needs to comply with all the requirements of international standards for Visa and Mastercard PCI/DSS, OWASP, and OWASP. At the same time, the application itself should remain clear and user-friendly. The most difficult task is to combine security and usability requirements. The challenge for the development team is to think through the user interface and user behavior scenarios in a way that not only improves the UX but also ensures security and meets all legal requirements.

AI

The use of artificial intelligence in fintech app development is changing the industry. AI-based technologies have been actively used in such systems and services as customer scoring, business forecasting, customer segmentation, automatic calls, ATM cash forecasts, and analysis of the location of offline outlets.

Mobile version

No serious service today can afford to have only a web version. All users expect a convenient fintech mobile app with full functionality. For businesses, mobile app users have, on average, 6-7 times better return on service than website users, and about 1.5 times better return on average.

Personalization of service

Data on transactions and customer requests within the fintech app allow not only to provide the user with charts of their expenses and income but also to prepare personalized offers. Scoring data and information from the bank's CRM are taken for analysis.

User-friendly interface

For financial services, the fintech app’s interface is becoming the main way to communicate with users. User-friendliness is one of the main competitive advantages in fintech app development. Developers are trying to polish the UX as much as possible to reduce the number of steps a user needs to take in order to perform the target action. One way to improve the UX is to prepare simple, clear, and easy-to-enter templates and use auto-substitution.

What do you need to build a fintech app?

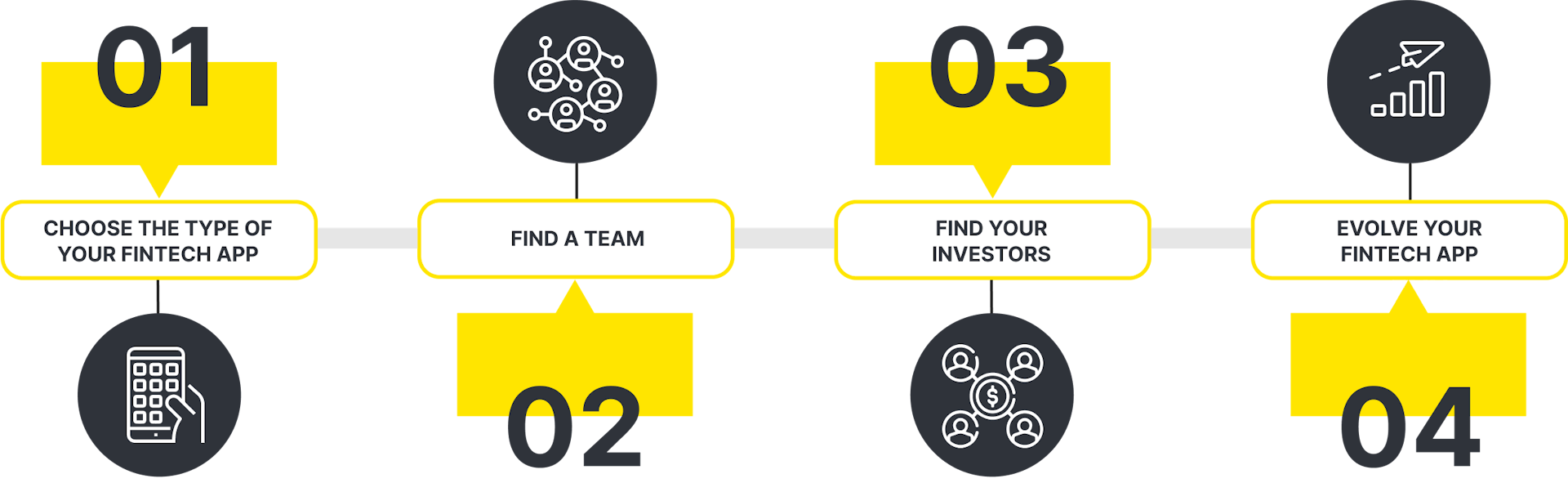

To build a fintech app you need to take into account many various factors - market trends, your potential users’ needs. Moreover, you should outline the key value of your product, find a reliable team to cover all the tech issues, and create a strong marketing strategy to ensure your product’s popularity. Let’s look at this question in more detail.

Choose the type of your fintech app

Fintech industry is very comprehensive, so the first thing you should do before jumping into fintech mobile app development is to decide which type of app you want to deliver to the market. There are many types of fintech app, now we’re going to take a closer look to the most popular ones:

- Loan apps - apps that are aimed at making lender-borrower interactions more effective, reliable and fast. With the help of these apps, the users can manage the loan process to the full extent - from the applying to loan payments.

- banking apps - this type of apps allow users to get all the banking services via their gadgets. It means that you can track your banking account activity, control your balance, make payments, transfer costs, pay utility bills, book flight/train tickets, etc.

- Insurance apps - help assess insurance risks more accurately, apply for coverage easier and faster.

- Investment apps - thanks to AI and other advanced technologies, these apps can help find you the best options for investment based on your budget, risks, and other important factors.

- Personal finance management apps - with the help of statistics, diagrams, and other user-friendly visualization, you can easily control your daily spendings, get tips and warnings on how you should spend money to stay afloat and grow with your budget, etc.

Find a team to build a fintech app

Based on your budget and needs, you can hire a software development company or freelance fintech app developer. Both options are good, but keep in mind that software development companies usually have more experience and expertise, can provide you with a full package of software development services, and have better project management and customer care.

Moreover, software development companies can allocate a dedicated team for your project. It means that all the team members dive deep into your project, are focused on your business goals and problems, build a fintech app for you only and can’t be switched to other projects.

By the way, we recommend you to pay attention to the Ukrainian software development companies because of the most fair price-quality ratio and amazing results they usually deliver. Contact Perfsol - a custom software development company which specializes in fintech app development. We not just create high-quality code but also provide IT consulting, integration with third-party platforms and support on every stage of your project growth. Check out our fintech cases!

In simple terms, Minimum Viable Product (MVP) is a mini-version of your software. It allows you to build a fintech app with a minimal and very basic functionality that still can be used by your target audience. MVP approach is widely used in various industries, as well as in fintech. The core goal of MVP development is to build a fintech app and release to the market as fast as possible, engage first users and analyze their feedback. Based on this, you can test the viability of your idea and whether your product brings a real value to the customers. Also you can define what features are necessary and which ones you should change and continue building your fintech app with the correct approach.

MVP advantages:

- It provides you with a visional clarity as, first of all, you have to focus on your core functionality

- It’s development requires minimum time and costs, that’s why you can launch it really fast

- It helps build early relationships with customers and gain users loyalty

- It’s very flexible so you can make as many changes as are necessary to deliver the best possible final product

- It increases your chances to engage investors

Find your investors

Now with MVP on board you can think of finding investors to conduct the full-range product development. There are several options where you can find the best possible investor to build a fintech app, pick the one you like most:

- Fundraising platforms (like Kickstarter)

- Private investors (for example, check AngelList)

- Incubators & Accelerators (like Y Combinator)

What you should definitely do, regardless of what type of investor you are going to involve to your fintech startup, you should be ready to pitch your product - to communicate the value of your idea, show the competitiveness of your software and necessity to build a fintech app, make a deep market research and make some forecasts on how you can scale and grow in several months and years.

How can you evolve your fintech app?

- Keep in the loop of the market changes and trends to stay one step ahead of your competitors

- Investigate your users experience and make your design more convenient and catchy

- Think of the advanced features for your fintech application, for example, for your Premium users

- Use up-to-date technologies: AI, chatbots, voice recognition, blockchain, etc.

- Improve your app security with new technologies and methods

- Build a strong marketing strategy

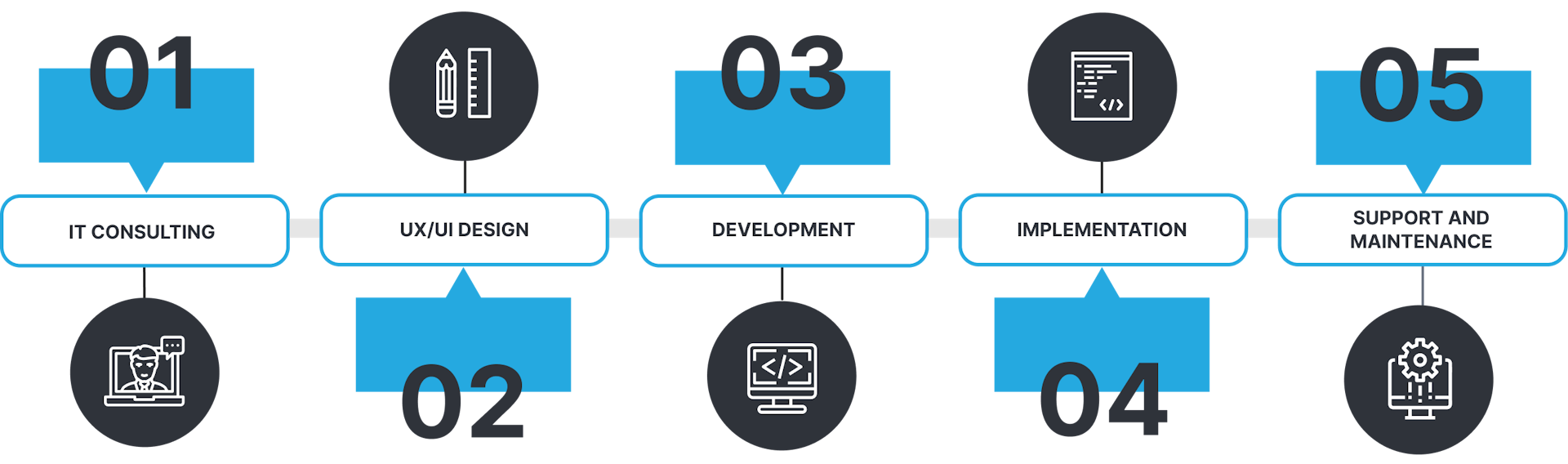

Fintech app development stages

You should follow a strictly tested development workflow in order to start a fintech app development project of high quality and functionality. Let's take a look at the stages of fintech app development.

IT Consulting

At this fintech app development stage specialists of the company headed by business analyst will listen to your ideas, make research of your needs, and provide you with a plan of further actions.

UX/UI design

At this fintech app development stage, the logic of the interaction of the app’s elements and their appearance are developed. UX/UI designers ensure that people will feel comfortable and pleasant using the service. This determines how often people will use the app.

Development

Direct writing of fintech app’s code by developers. At this fintech app development stage, specialists will build the software’s frontend, backend, and test it in order to avoid bugs.

Implementation

Technological upgrade should not put your company on pause. During this fintech app development phase, experts ensure that the app is implemented in your business processes in the most cost- and time-efficient manner.

Support and maintenance

Once the fintech app is released, you need to constantly monitor its performance. In addition, new features and functions are added at this fintech app development stage.

Fintech app development cost

The cost of a fintech app development is determined by two factors. The first is the time it takes to develop a fintech app. The second is the cost of specialists’ services per one hour of that time. On average it takes them about 3000 hours for fintech app development. If the average specialist's rate in the USA or Western Europe is about $90 per hour, then fintech app development will cost you around $200 000.

How to reduce fintech app development cost

There are several ways to reduce the cost. Let’s take a closer look at them.

Outsourcing

The most effective way to save money on fintech app development is outsourcing. The idea is that you hire a development team in a country where the specialist rates are lower than in yours. This way you can cut the fintech app development cost in half.

MVP development

You can develop a minimum viable product or MVP. This is a fintech app that includes only key functionality. With an MVP you can test the fintech app for viability, and then gradually add the rest of the features to it.

Detailed project requirements

Properly drafted project requirements allow you to understand exactly what will be developed and how much will fintech app development cost. To draw up such requirements, it is highly recommended to find a team of fintech app development experts with consulting services.

When starting modern fintech app development projects, issues of customer centricity and cybersecurity come to the fore. Even the older generation is going online en masse, mobile apps are replacing classic plastic payment cards from everyday life, and financial transactions themselves are becoming more and more seamless and invisible to the consumer. The winner is the one who is the first to offer the user freedom and comfort in dealing with their money: a fast, reliable, and convenient banking app. Ensure this with the help of Perfsol's top-notch development team and get ahead of the curve with a cutting-edge fintech solution.

Building a Fintech App: Successful Case by Perfsol

MXNEY is the go-to financial app for e-commerce. The project was pretty extensive, so we brought together a crew of tech and business pros: developers, analysts, PMs, designers—you name it. It gathers stats from platforms and shopping systems, controls sales, defines revenues — you name it. Our fintech app is robust and user-friendly, offering seamless card management, tracking of all payment deadlines, and other financial operations. Check out what we've got under the hood:

- Transactions list

- Security regulations: KYC, KYB

- Credit documentation

- Working with Direct debit schemes

- Online wire transfers

Plus, we hooked up integrations with Shopify, Magento, WooCommerce, Prestashop, Shoporama, Smartweb. We even got linked with Aiia Open Banking (Mastercard) and synced up with Facebook Ads Manager, Google Analytics, and Google Ads.

Got a fintech app idea brewing? Let's chat about how to build a fintech app for you and guide your project to success, just like we've done for all our clients!

Author

CEO

I follow a proactive approach in life to solve simple to complex problems systematically. I fully understand the nexus of people, process, technology, and culture to get the best out of everyone at Perfsol to grow the businesses and deliver a societal impact at the national and global levels.

FAQ

What team is required for fintech app development?

For quality app development in the fintech industry, you should first of all pay attention to the development teams that already have experience in this niche. Choose development teams with ready projects in fintech and fully staffed with all the necessary specialists.

How much does it cost to develop a fintech app?

The cost of fintech app development in the U.S. and Western Europe will be around $200,000. This sum can be halved if you order the development of a fintech app in other regions.

How to reduce cost and speed up fintech app development?

The most effective way to speed up development and reduce the cost of fintech app development is outsourcing. By resorting to the services of outsourcing development companies you get a team of specialists ready to build you a quality product for a reasonable fee.