Fintech Software Development Company Perfsol

Perfsol

Fintech Software Development Company Perfsol

Trust the professionals of fintech software development and let your business thrive while advanced technology solutions make you money for you.

Fintech Software Development Services by Perfsol

The fintech sector is thriving yet highly competitive. Substantial investments, ingenious startups, and high demand on a global scale. You might already have felt competitors snapping at your heels. But that’s just until you partner with Perfsol. We help you reach your target audience, which is, most probably, millennials, as they’re actively driving the consumer force and are said to be the dominant generation in the financial space in the coming years.

So you can count on our fintech experts and the software development services they render to enrich your technological portfolio and respond to the market demand quickly.

Exploring new business models, entering new markets, and satisfying exquisite customer needs, while offering top-level customer experience — all is possible with our fintech software development services. Experienced Perfsol engineers, solution architects, project managers, and other professionals are ready to strengthen your team, offering you the following services.

IT consulting

Contact our experts, briefly describe what you need, and get a detailed analysis of your business with possible ways to implement your ideas

Fintech UI/UX design

Developing app’s appearance along with the logic of user and fintech software interaction. Designing a neat and functional interface.

Fintech software development

Сreation of fintech software. Fintech software development service includes code writing, testing, and optimization so that no unforeseen issues could stand between you and users.

Fintech application development

Fintech software development for mobile devices. Discover a powerful financial management tool that fits in your pocket.

Integration and implementation

Integrating fintech software into your company in line with your business processes.

Training and support

Training your employees on using the new fintech software and monitoring the app status.

Fintech Software Development Company Perfsol

Perfsol is a custom fintech software development company established in 2018. We gathered top-notch software development specialists, uniting them around a common idea — producing tangible results for clients and offering them real value based on their needs and expectations. Relying on Perfsol for fintech application development is a smart choice, and here’s why:

Proven track record. Our hiring approach is one of the keys to customer satisfaction. First, we cherry-pick fintech experts with deep industry knowledge. Then we do our best to support their professional development and technical competence. We guarantee you’ll deal only with well-versed fintech specialists.

Full-cycle fintech app development. From idea ideation through fintech UI/UI design, software development, and QA services — we’ve got you covered. Whatever the stage of your product development, we have the right specialists to turn it into success.

Agile methodologies. At Perfsol, we’re devoted adepts of Kanban and Scrum. On top of that, we use DevOps practices as powerful tools to expand collaboration and adapt to your needs that naturally may change in the course of product development.

Shahar Mintz

Director of Web Engineering, Riverside.fm

Delivering multiple web technologies, Perfsol is a consistent and dependable partner. Their communication stands out as excellent compared to outsourced competitors, interacting over Slack and Jira.

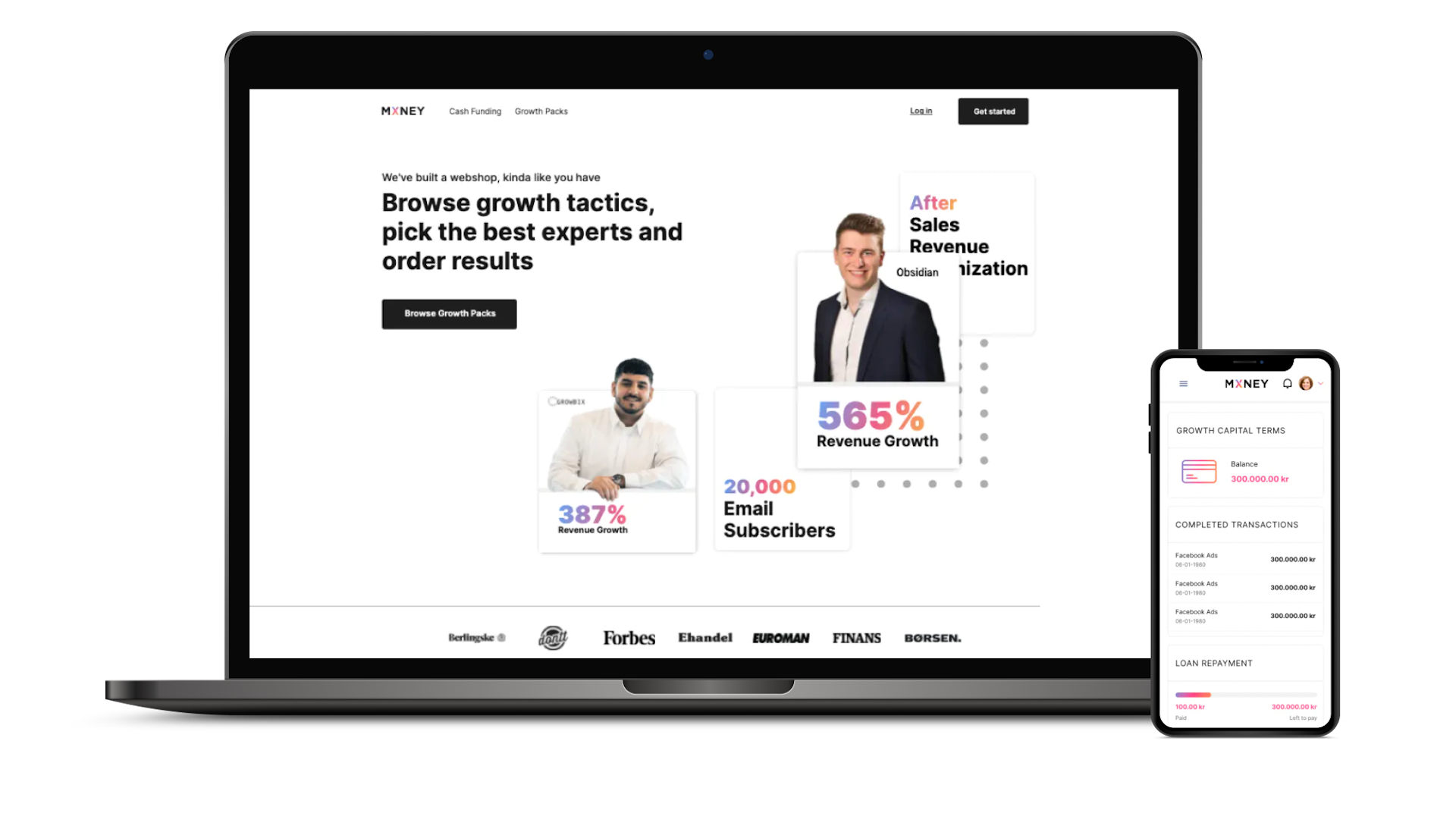

Christian Madsen

Head Of Technology, MXNEY

The client's development scalability and speed have increased thanks to Perfsol's quality work. Their commitment to understanding the business needs has been key to reaching the expected goals.

Hire Fintech Developers at Perfsol

Fintech Developers for Hire at Perfsol offer cutting-edge expertise in financial technology solutions. With a deep understanding of both finance and technology, our skilled developers create innovative and secure software tailored to the needs of the fintech industry. Whether it's developing robust payment systems, building AI-powered investment platforms, or crafting blockchain-based solutions, our team delivers efficient and scalable solutions.

Senior Frontend developer

Front-end Developer with a robust skill set, boasting six years of commercial development experience. Proficient in a wide range of technologies, including React, Redux, Next.js, Effector, TypeScript, and Jest. Committed to producing high-quality user interfaces and offering assistance and guidance to aspiring developers.

Specialization

React

TypeScript

Yelyzaveta K.

Middle PHP Backend developer

PHP developer with 3+ years of experience in designing, developing, testing, and implementing various client-server architecture-based enterprise applications. I am especially keen on math, algorithms, and complex problem-solving. Committed to learning and self-development to consistently achieve better results and help the team out in challenging times.

Specialization

PHP

Laravel

Why hire fintech software developers from Perfsol

Whether you're a startup aiming to disrupt the traditional financial industry or an established financial institution seeking to stay competitive, choosing the right fintech software developer is a critical decision. This is where Perfsol comes into the picture. Since 2018, we have been making waves in the fintech development space. Our cutting-edge solutions and a commitment to end-to-end excellence make us your best pick for fintech software developer. So If you're on the hunt for a dependable fintech software development company, here are your reasons to give us a thought.

Vast fintech experience

We bring a wealth of experience to the table. Over the years, we have been acquiring and implementing a deep understanding of the fintech industry. Working with us means you hire a fintech development company that truly gets the ins and outs of fintech projects.

Full-cycle development

From grasping the initial idea to updating the final product, our fintech development services cover it all. We believe in providing end-to-end solutions with no third party involved, making software development for fintech businesses seamless and streamlined.

Different cooperation models

We know that every project has its own requirements. That’s why, as a leading fintech software development company, we offer both outsourcing and outstaffing. This flexibility allows you to choose the cooperation model that best fits your project's needs and budget.

Security and regulatory compliance

Our fintech software development services prioritize the development of top-tier solutions that are secure and compliant with all necessary regulations. You can trust our fintech development company to put your security needs first.

Agile approach

We embrace an agile approach, breaking your fintech software development into attainable stages. This facilitates rapid development and iteration, making sure your fintech solutions stay adaptable and responsive to the needs of your audience.

Proficiency with microservices

We structure an application as a collection of small, independently deployable pieces. We carefully develop, deploy, and scale each unit, ensuring your solutions are robust, adaptable, and ready to cater to future growth and market changes.

Fintech Software Development Solutions by Perfsol

Today, a fintech market looks like a vibrant puzzle made of multiple pieces of fintech trends. There is an increased demand for AI-powered fintech products, advanced P2P solutions, and interoperability through open banking APIs.

On top of that, automating regulatory compliance — Know Your Business (KYB) and Know Your Customer (KYC), to mention just a few top approaches — is very much favored by businesses. It helps them save money and opens up opportunities for regtech startups. The European Union's Second Payment Services Directive (PSD2) evolves into a merchant enablement approach, while personalization and gamification help your product stand out among the competitors.

Do you want to implement these trends successfully? Perfsol will be pleased to assist you, no matter what type of solutions you need.

Digital payments

Send money in the blink of an eye. Integrate the most popular payment systems into your fintech solution and watch new users flood in.

Cybersecurity

A good fintech product must be one hundred percent secure. We'll make sure it’s done with best practices and solutions in the cybersecurity niche.

Big Data and AI

With more and more data out there, ordinary people find it hard to analyze it. Strengthen your fintech solution with AI-enabled data collection and analysis technologies.

Banking

Merging banking and IT has enabled consumers to use financial services from anywhere. Enjoy greater comfort in banking by going digital.

Financial management

Manage your finances with a few clicks or taps. Money should work, and quality fintech software is a great help in that.

Blockchain

Blockchain application possibilities in fintech software are huge. From cryptocurrencies to secure smart contracts, blockchain is your ticket to a new era.

Fintech Software Projects Developed by Perfsol

Perfsol has years of experience in the development of fintech software and dozens of successfully completed projects. You don't have to listen to what we have to say about ourselves, but we strongly recommend you to read the feedback from our clients. Noone will be more eloquent about a company as people who did business with it and were highly satisfied with the result.

MXNEY: Financial App For Ecommerce

We have developed a feature-rich application to take financial management to a whole new level.

Promis: Invoicing software screens redesign

We have redesigned the app to display invoices and manage sales more effectively in real-time.

Transformify: Multi-Functional Workforce Management Tool

Seamlessly automate the onboarding, billing and payments to thousands of vendors, affiliates, workforce on-demand and freelancers.

From idea to Taxi app in a few months

Inspired by our Canadian customer’s vision to build the first carbon neutral taxi app, we went on to develop and design a customer journey for the best ride.

FAQ

How to find the right fintech software development team?

The hallmarks of a great fintech software development team are reviews and case studies from real customers. Also, pay attention to company’s ranking on various reviews platforms, such as Clutch.

How to build a fintech software fast?

The most effective path toward fast fintech software development is working with experienced companies who know exactly what you need. Start small and gradually add more features to your fintech solution.

What are fintech software development trends?

Solutions focused on cybersecurity and blockchain are the hottest trends in fintech software development. The use of big data and artificial intelligence is gaining momentum, too.